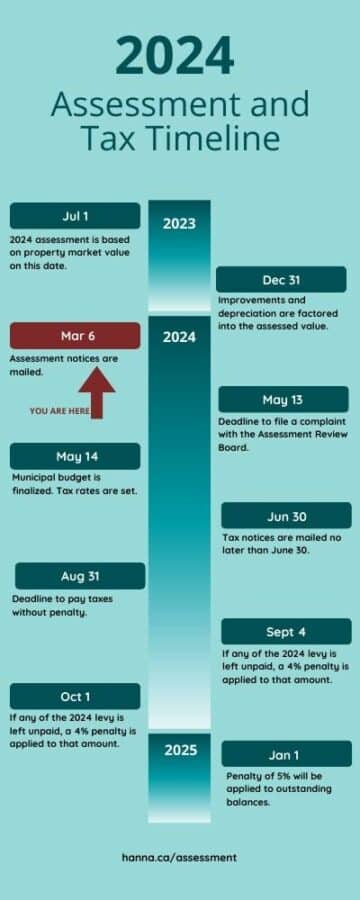

Annual assessment notices for the year 2024 were sent out to all property owners on March 6, 2024. Each notice includes a 60-day review period, clearly stated within the notice itself.

These assessments are based on the economic conditions as of July 1, 2023, and the physical state and characteristics of the property as of December 31, 2023. They are sent out before property tax notices to allow property owners the chance to examine and address any concerns regarding their assessed value before tax calculations are finalized.

To ensure the accuracy of your assessment, it is recommended that you carefully review your Assessment Notice. Verify that your name, mailing address and civic address are correct and that the property classification (e.g., residential, farmland, non-residential) accurately describes your property. You can also compare your assessment to those of similar properties in terms of size, age, quality, condition, and location. All assessments are accessible for review on the Town of Hanna website at Hanna.ca/property-search. Simply type the street name or number to review assessments.

Should you have any questions or concerns after comparing your assessment to market values and those of neighboring properties, you are encouraged to contact the Town Office at (403) 854-4433 or the Town of Hanna Assessor, Terry Willoughby of Municipal Property Consultants (2009) Ltd., at (403) 309-4190.

Forms for lodging complaints with the Assessment Review Board can be obtained either at the Town Office (located at 202 – 1 Street West) or online at Hanna.ca/appealprocess.

Tax notices for the year 2024 will be sent out in June, with taxes due by August 31, 2024.