Did you know that you may NOT appeal your property taxes? You may however appeal the assessment of your property, which is what your taxes are based on.

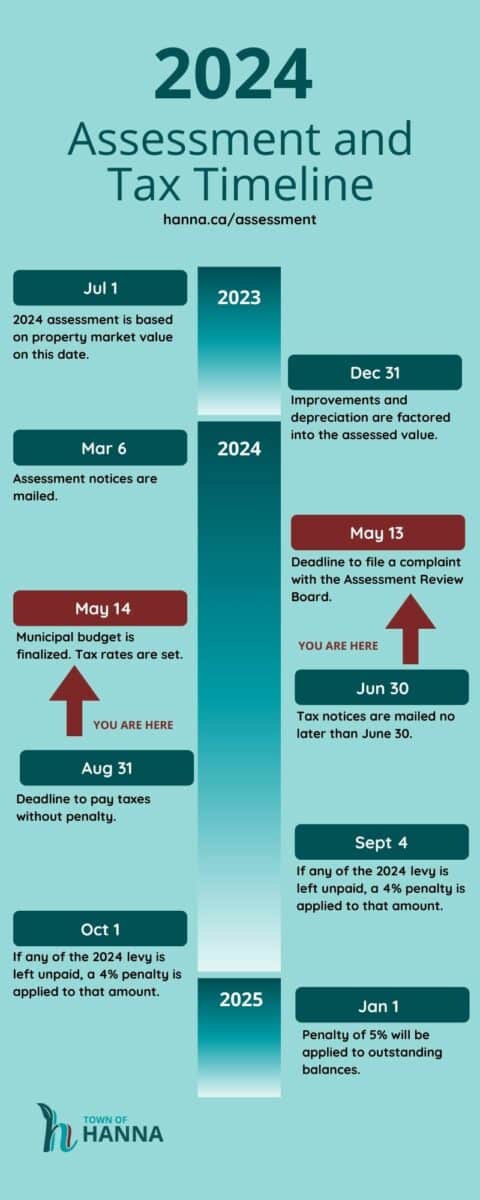

The deadline to appeal your assessment is May 13, 2024.

Property Owners have the right to lodge a formal complaint against your assessment with the Joint Assessment Review Board.

The Joint Assessment and Review Board is responsible for hearing and ruling on assessment complaints. This volunteer Board ensures that the taxpayer and the assessor receive a fair and impartial hearing. The board hears complaints based on claims of errors or omissions, unfair assessments compared with similar properties, or incorrect classifications for tax rate purposes. Before filing your complaint, you are to discuss your concerns with the assessor.

You may only appeal the assessment, not the tax levy. The only parties authorized to change assessments are the Town of Hanna assessor and the Joint Assessment Review Board. Town of Hanna staff or members of Council do not have the authority to change assessments.

A written complaint must be delivered to the Joint Assessment Review Board clerk at the Town Office by the date shown on the property assessment notice (May 13, 2024). The appeal processing fee for each parcel or account must accompany the written complaint. The fee ranges between $50 and $650 depending on if your complaint is concerning a residential property, an apartment complex or a commercial property for example. (as per bylaw #954-2012)

If you plan to appeal, it would be best to pay the taxes by the due date to avoid penalty. If a decision is made in your favor, your assessment will be adjusted and any overpayment of taxes will be refunded.

Download the Assessment Review Board Complaint Form from Alberta Municipal Affairs.